APPLIED MATHEMATICS LABORATORY

APPLIED MATHEMATICS LABORATORY

STOCHASTIC SYSTEMS RESEARCH GROUP

Head: László Gerencsér

Financial mathematics

(E. Berlinger, L.Carassus, L.

Gerencsér, L. Györfi, Z. Mátyás, Gy. Michaletzky, G. Molnár-Sáska,

G. Morvai, Zs. Orlovits, M. Rásonyi, J. Száz, L. Stettner, Cs. Szepesvári, Zs. Vágó)

Arbitrage and large markets: In the theory of large financial markets it is

widely believed that there exist pricing measures exactly when there is no

arbitrage in an appropriate, asymptotic sense. Such a result has been obtained

in [40] for a class of models well-known in economic theory. An overview of

recent results on large financial markets (including those of the author) is

presented in [6*].

Applications of control theory to finance : The existence of optimal portfolio strategies and related risk-neutral pricing operators has been established in [39] and [5*] in cooperation with Lukasz Stettner (IMPAN, Warsaw Mathematical Institute of the Polish Academy of Sciences). In cooperation with Laurence Carassus (Université Paris 7) M. Rásonyi proved the continuity of optimal strategies with respect to investors’ preference relations. These results are based on those of [5*]. It has been conjectured that as risk-aversion of agents tends to infinity their respective utility prices (assigned to a contingent claim) tend to the superreplication (risk-free) price of the given claim. Up to now only very special cases of this conjecture have been shown. A further result of the above collaboration is a proof of this conjecture in a fairly general setting. These collaboration have been partly financed by the EU Centre of Excellence programme.

Behavioral finance : A stochastic feedback model for financial markets was proposed [22], in which the agent's decision is based on his beliefs of the price dynamics and his behavior reflecting his attitude, such as risk aversion or risk preference. A variety of behaviors of economic players is described by experimental psychologists, see for example the famous 1986 paper of Kahnemann and Tversky [35]. When a new agent enters the market, his/her anticipations and actions alter the market dynamics and a genuinely closed loop system arises. The market is in equilibrium if the agent’s beliefs no longer change the market dynamics. A data driven real-time procedure to find the equilibrium price predictor has been developed. The convergence of the resulting stochastic approximation procedure was analyzed using the techniques developed by Benveniste, Metivier and Priouret in [4], see also [20], and the conditions for convergence have been verified. Simulation results for various behaviors such as rational behavior, loss aversion and risk-seeking behavior were also presented. Using market dynamics fitted to real data and simple AR predictors, quick convergence of the parameter processes was established in all of our test examples.

The single-agent model was extended to a

comprehensive multi-player stock market model [21]. In this case the market dynamics is completely determined by stock

market regulations (for the currently used rules at the Budapest Stock Exchange

see [11] ) and the transaction requests of the agents.

Bid prices emerged as a new and essential element of the behavior. Various

sources of randomness were considered such as threshold dependent actions,

random bid prices and exogenous white noise. Initial experiments for the

computation of the optimal growth rates belonging to two different behaviors

(rational behavior and loss aversion) have been carried out. As preliminary findings

we noted that the wealth processes of non-rational players admit much higher

variability than those of rational players.

Stochastic volatility

models for financial time series :

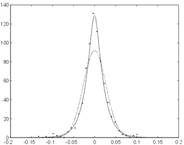

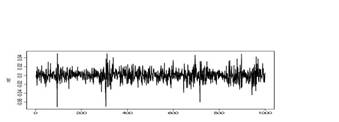

The log-returns of a stock exhibits a

so-called volatility clustering phenomena: long periods of low

volatility are followed by short periods of high volatility. A typical figure

for log-returns is given in the following Figure, an SP 500 daily data for 4

years (1997-2001):

It follows that the

conditional variance is time-varying, a fact not true for linear processes. The

first basic non-linear stochastic volatility model, due to R. Engle, is the

so-called ARCH process, in which volatility is modeled by a stochastic

non-linear feedback system driven by observed log-returns. A useful

extension is the GARCH model (see [10]). GARCH processes have been applied also

for estimating the volatility of index returns, see [38], and for modelling the

joint dynamics of futures contracts, see [12]. Alternative models have can be

obtained by using bilinear stochastic systems, see [44].

A key problem is the

estimation of the parameters of a GARCH model. Strong

consistency of the quasi log-likelihood function have been established under

very weak conditions by Berkes et al., see [5]. We have taken a

different route: by assuming stronger conditions on the driving noise and

extending the techniques for ARMA processes (see [27, 28]), we have derived

strong approximation results both for the standard quasi-maximum-likelihood

estimator and also for its fixed gain version.

A basic problem is to detect structural changes in the market, which is reflected in changes of the GARCH parameters. There are several methods for detecting these changes such as hypothesis testing (see [6]), or asymptotic and bootstrap tests (see [32]). A change point detection method for GARCH processes inspired by the results of [26] and [2], leading a kind of Hinkley detector with appropriately defined residuals has been developed in [23].

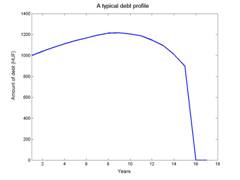

Student loan systems: A stochastic model for the Hungarian student loan

system has been developed [7]. The creditor's risk was investigated in terms of

the two basic control parameters of the model, the risk premium and the

repayment quotient. Special features of the Hungarian system, such as

self-financing and writing off the debt at retirement, were also incorporated

into the model. The dependence of the creditor’s profit and the borrower’s

welfare on basic intervention parameters was analyzed using a number of

simulation examples. The findings allow for a reasonable choice of parameters

which makes the system sustainable for the lender and attractive for the

borrower. A typical debt profile is given on the figure:

Logoptimal portfolios: Logoptimal portfolios, ensuring the maximal growth rate of the wealth

process, with transaction costs, an extension of the basic model of [13], have

been studied. This has led us to a hard

MDP (Markov Decision Process) problem. A direct approach would be to develop on-line data driven procedures, see [42], and also [34].

This has led to the sub-problem of estimating the conditional expectation of

any day’s return given the past. It is known that there is no universal method

for getting a strong consistent solution to this problem. Partial results for

Gaussian processes have been obtained in [33] and Schafer [43]. The results of

the latter have been extended for a wider class of Gaussian processes.

Recent results on control-Lyapunov-exponents of random matrix products have been applied to optimize logarithmic growth rate of currency portfolios under minimal conditions on the exchange rate matrix. The theory has been reaffirmed by simulation results, [31].

Hidden Markov

Models

(L. Gerencsér, I. Kmecs, Gy. Michaletzky, G. Molnár-Sáska, T. Szilágyi, Zs. Vágó)

Estimation of HMM-s : Hidden Markov Models

(HMM-s) are widely used due to their flexibility in modelling dynamical

phenomena in engineering, physics and economy. For the latter see [16], [18],

[36], [19]. A basic problem in the

theory of Hidden Markov Models is the estimation of the dynamics of the process. A tight connection between the estimation theory

of HMM-s and linear stochastic systems have been established in [2*], via the realization techniques of V. Borkar, [8] and the theory of L-mixing processes, [25]. As a

byproduct, conditions for non-linear stochastic systems are given under which

an L-mixing input generates an L-mixing output.

In establishing the above connection a key role is played by what is

called uniform exponential stability of the filter process ([1], [37]). The

results of [2*] have been extended to general compact state-space using the

results of [15]. These results have been applied to derive strong approximation

theorem for the estimates of HMM-parameters, [2*].

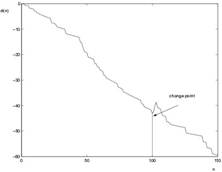

Another basic problem is to detect structural changes in the model. A change point detection method for HMMs has been inspired by the results of [26] and [2], leading a kind of Hinkley detector with appropriately defined residuals, [24]. An inflection in the on-line Hinkley statistics gives a clue for a change, see the figure below:

Quantized Gaussian linear models: We have investigated the identification of quantized Gaussian linear models. Our primary interest is in the estimation of quantized Gaussian ARMA-processes for speech restoration in mobile communication. This leads to integration in dimension 320 for a special MCMC (Markov Chain Monte Carlo) has been developed. The identifiability issue has been settled in [7*]. For static models, given by quantized linear regression, an effective real-time resursive estimation method, a randomized EM (Expectation Maximization) method has been developed and analyzed, [17].

Stochastic adaptive control and optimization

(L. Gerencsér,

S. Hill, Gy. Michaletzky,

Zs. Vágó)

Recursive

estimation : Risk sensitive estimation of

multivariable linear stochastic systems have been introduced and investigated.

This is a genuinely recursive estimation method with a weight matrix as a

design parameter. The optimal weight matrix has been determined using results

of stochastic realization theory, [4*]

More application to a basic result on the strong

approximation of recursive estimators leading to an exact characterization of

the loss in performance in stochastic adaptive control have been developed in [3*].

SPSA in discrete optimization. : The minimization of quadratic functions over the set of grid-points with integer coordinates is a basic problem in resource allocation fo r network design. We have further improved an MCMC (Markov-Chain Monte-Carlo) method in whic the initial Markoc chain is generated by the SPSA (simultaneous perturbation stochastic approximation) method by a careful choice truncations, averaging and acceptance probabilities ([29], [30], [1*]).

REFERENCES:

[1] ARAPOSTHTATIS, A.

– MARCUS, S. I.: Analysis of an Identification Algorithm Arising in the

Adaptive Estimation of Markov Chains, Math. of

Control, Signals and Systems, vol. 3, pp.1-29, 1990.

[2] BAIKOVICIUS, J. - GERENCSÉR, L.: Change point detection in a stochastic complexity framework. In: Proceedings of the 29-th IEEE CDC, vol. 6, pp. 3554-3555, 1990.

[3]

BAILEY, D. H.: Sequential Schemes for Classifying and Predicting Ergodic

Processes. Ph. D. Thesis,

[4] BENVENISTE, A. –

MÉTIVIER, M. - PRIOURET, P.: Adaptive Algorithms and Stochastic Approximations.

Springer Verlag,

[5] BERKES, I., - HORVÁTH, L., - KOKOSZKA,

P.S.: GARCH processes: structure and estimation. Bernoulli, vol.

9, pp. 201-207, 2003.

[6] BERKES, I., HORVÁTH, L., KOKOSZKA, P.S.: Testing for parameter constancy in GARCH(p,q) models. Statistics and Probability Letters, forthcoming.

[7] BERLINGER, E. - GERENCSÉR, L. - MÁTYÁS, Z. – RÁSONYI, M.: Analysis of an income contingent student loan system, manuscript, 2004.

[8] BORKAR, V. S.: On white noise representations in stochastic realization theory. SIAM J. Control Optim., vol. 31, pp.1093--1102, 1993.

[9] BOLLA, M. – MOLNÁR-SÁSKA, G.: Optimization problems for weighted graphs and related

correlation estimates. Discrete Mathematics, vol. 282, no. 1-3, pp. 23-33., 2004.

[10] BOLLERSLEV, T.: Generalized autoregressive conditional heteroscedasticity. Journal of Econometrics 31, pp. 307-327, 1986.

[11] Budapest Stock

Exchange, http://www.bet.hu/onlinesz/index.html.

[12] CHRISTENSEN, B.S.: Dynamic Programming, Multivariate GARCH models, and Futures Hedging. In: Proceedings of the International Conference on Stochastic Finance, Lisbon, Portugal, September 26-30, 2004, (electronic).

[13] COVER, T. M.: An algorithm for maximizing expected log investment return. IEEE Trans. on Information Theory, vol. 30, no. 2, part 2, pp. 369—373, 1984.

[14] COVER, T. M.: Open problems in information theory. In: Proceedings of the 1975 IEEE Joint Workshop on Information Theory, “IEEE Press”, New York, pp. 35-36, 1975.

[15] DOUC, R. – MATIAS, C.: Asymptotics of the Maximum likelihood estimator

for general Hidden Markov Models. Bernoulli, vol. 7,

pp. 381-420, 2001.

[16] ELLIOTT R. - VAN DER HOEK, J.: An application of hidden Markov models to asset allocation problems. Finance and Stochastics, vol. 1, no. 3, pp. 229-238,1997.

[17] FINESSO, L. - GERENCSÉR, L. – KMECS, I.-SZILÁGYI, T.: Estimation of quantized Gaussian linear models - a randomized EM method. Int. Journal of Adaptive Control and Signal Processing Control, submitted.

[18] FUH, C.D. – HU, I. – LIN, S.K.: Empirical performance and asset pricing in hidden Markov models. Comm. Statist. Theory Methods, vol. 32 , no. 12, pp. 2477-2512, 2003.

[19] GENON–CATALOT, V. – JEANTHEAU, T. – LAREDO, C.: Stochastic volatility models as hidden Markov models and statistical applications. Bernoulli, vol.6, no. 6, pp. 1051—1079, 2000.

[20] GERENCSÉR, L. – MÁTYÁS, Z - MOLNÁR-SÁSKA, G. - ORLOVITS, ZS..: Statistical theory of non-linear stochastic systems. I. www.sztaki.hu/~gerencs/download/BMP.ps

[21] GERENCSÉR, L. – MÁTYÁS, Z.: A behavioral stock market model. In: Proceedings of the International Conference on Stochastic Finance, Lisbon, Portugal, September 26-30, 2004, (electronic).

[22] GERENCSÉR, L. – MÁTYÁS, Z.: A system theoretic approach to behavioral finance. In: Proceedings of the 43rd IEEE Conference on Decision and Control, Nassau, The Bahamas, December 14-17, 2004, TuA10.2.

[23] GERENCSÉR, L. – MOLNÁR-SÁSKA, G. – ORLOVITS, Zs.: Change-detection of Hidden Markov Models and GARCH processes. In: Proceedings of the International Conference on Stochastic Finance, Lisbon, Portugal, September 26-30, 2004, (electronic).

[24] GERENCSÉR, L. – MOLNÁR-SÁSKA, G.: Change detection of

Hidden Markov Models. In: Proceedings of the 43rd

IEEE Conference on Decision and Control, Nassau, The Bahamas, December

14-17, WeA11.2, 2004.

[25] GERENCSÉR, L.: On a class of Mixing Processes. Stochastics, vol. 26, pp. 165-191, 1989.

[26] GERENCSÉR, L.: Predictive stochastic complexity associated with fixed gain esstimators. In: C. Praagman, J.W. Niueuwenhuis and H.L. Trentelman, (editors), Proceedings of the 2nd European Control Conference, Groningen, pp. 1673-1677, 1993.

[27] GERENCSÉR, L.: On the Martingale approximation of the estimation error of ARMA parameters. System & Control Letters, vol. 15, pp. 417-423, 1990.

[28] GERENCSÉR, L.: Fixed gain off-line

estimators of ARMA parameters. Journal of Mathematical Systems,

Estimation and Control, vol. 4, no. 2, pp. 249-252.

[29] GERENCSÉR, L. – HILL, S.D. - VÁGÓ, Zs. – VINCZE, Z.: Discrete optimization, SPSA and Markov Chain Monte Carlo methods. In: Proceedings of the American Control Conference 2004, June 30 - July 2, 2004, Boston, MA, USA, ThP17, pp. 3814-3819.

[30] HILL,S. D. – GERENCSÉR,L. -

VÁGÓ,Zs.: Stochastic Approximation on Discrete Sets Using Simultaneous

Perturbation Difference Approximations. In: Proceedings

of theAmerican Control

Conference 2004, June 30- July

2, 2004, Boston, MA, USA, ThM06, pp. 2795-2798.

[31] GERENCSÉR,L. – RÁSONYI, M.-VÁGÓ,Zs.:

Controlled Lyapunov-Exponents with Applications. In: Proceedings of the 43rd

IEEE Conference on Decision and Control, Nassau, The Bahamas, December

14-17, WeC08, 2004.

[32] GOMBAY, E.: Sequential change point detection

and estiamtion. Sequential Analysis 22, pp. 203-222, 2003.

[33] GYÖRFI, L. – LUGOSI, G.:

Strategies for sequential prediction of stationary time series, In: Dror, M. – L’Ecuyer, P. – Szidarovszky, M.(editors): Modeling

Uncertainity: An Examination of Stochastic Theory,

Methods, and Applications. Kluwer Academic Publishers,

pp. 225-248, 2002.

[34] HELMBOLD, D. P. –

SCHAPIRE, R. E. – SINGER, Y. – WARMUTH, M. K.: On-Line Portfolio Selection

Using Multiplicative Updates, Mathematical Finance, vol. 8, pp. 325-347,

1998.

[35] KAHNEMANN, D. - TVERSKY, A.: Rational Choice and the Framing of Decisions. Journal of Business,Vol. 59, pp. 251-278, 1986.

[36] LANDEN, C.: Bond pricing in a hidden Markov model of the short rate. Finance and Stochastics, vol. 4, no. 4, pp. 371-389, 2000.

[37] LEGLAND, F. – MEVEL, L: Exponential Forgetting and Geometric Ergodicity in Hidden Markov Models. Mathematics of Control, Signals and Systems, vol. 13, pp. 63-93, 2000.

[38] MAMMADLI, S.: Analysis of stock return and volatility using GARCH models: the case of Turkey. In: Proceedings of the International Conference on Stochastic Finance, Lisbon, Portugal, September 26-30, 2004, (electronic).

[39] RÁSONYI, M.: Utility maximization in discrete-time financial market models. In: Proceedings of the International Conference on Stochastic Finance, Lisbon, Portugal, September 26-30, 2004, (electronic).

[40] RÁSONYI, M.:

Arbitrage theory and risk-neutral measures. Decisions in

Economics and Finance, vol. 27, no. 2, pp. 109-123, 2004.

[41] RYABKO, B. YA.:

Prediction of random sequences and universal coding. Problems

of Information Transmission (Problemy Peredachi Informatsii), vol. 24, no.

2, pp. 3-14, 1988.

[42] SCHAFER, D.: Nonparametric Estimation for Financial Investment under Log-Utility. Ph.D. thesis, Mathematisches Institut A der Universitat Stuttgart, 2002.

[43] SCHAFER, D.:

Strongly consistent online forecasting of centered Gaussian processes. IEEE

Trans. on Information Theory, vol 48, no. 3, pp. 791-799, 2002.

[44] TERDIK, GY.: Bilinear Stochastic Models and Related Problems of Nonlinear Time Series Analysis. Lecture Notes in Statistics, Springer Verlag, New York, 1990.

PUBLICATIONS TO APPEAR:

[1*] HILL, S. D. – GERENCSÉR. L. - VÁGÓ, Zs.:

Discrete Stochastic Approximation via Simultaneous

Difference Approximation. American

Control Conference 2005, June

8 – June 10,

[2*] GERENCSÉR, L. – MICHALETZKY, GY. – MOLNÁR-SÁSKA, G. –

TUSNÁDY, G.: A new approach for the statistical analysis of Hidden Markov

Models. IEEE Trans. Automatic Control, under revision

[3*] GERENCSÉR, L.: A representation theorem for recursive estimators. SIAM Journal on Control and Optimization. Accepted for publication.

[4*] GERENCSÉR, L. - MICHALETZKY, Gy. - VÁGÓ, Zs.: Risk-sensitive identification of linear stochastic systems. Mathematics of Control, Signals and Systems. Accepted for publication.

[5*] RÁSONYI,M.

– STETTNER, L.: On utility maximization in discrete-time market models. Annals

of Applied Probability, Accepted for publication.

[6*] RÁSONYI, M.: Arbitrage on large

financial markets (in Hungarian). SIGMA, accepted for

publication.

[7*] SZEIDL, Á. – GERENCSÉR, L. –

MICHALETZKY, GY.: Quantized Gaussian ARMA

identification. Systems and Control Letters, accepted for publication.

GRANTS, AWARDS

Project title: Stochastic

Systems and Modelling Financial Markets

Hungarian National Science Foundation (OTKA)

Supervisor: L. Gerencsér

OTKA grant No.: T047193

Duration: 2002-2006

APPENDIX 1

EDUCATIONAL ACTIVITIES

a. Graduate

courses

Gerencsér, L.:

Péter Pázmány Catholic University,

Faculty of Information Technology,

Budapest,

Information and coding theory (lecturer)

2003/2004/I.

Mátyás, Z. :

Péter Pázmány Catholic University,

Faculty of Information Technology,

Probability theory and statistics (TA),

2004/2005/I.

Molnár-Sáska,

G.:

Budapest University of Technology and Economics,

Institute of Mathematics,

Seminar on applied mathematics

2004/05/I

Statistics

2004/05/I

Central European University,

Department of Computer Sciences,

Statistics (lecturer)

2003/2004 /II

Péter Pázmány Catholic University,

Faculty of Information Technology,

Probability theory and statistics (TA)

2004/05/I

Orlovits, Zs.:

Péter Pázmány Catholic University,

Faculty of Information Technology,

Budapest,

Analysis (TA)

2004/2005/I

Rásonyi, M.:

Péter Pázmány Catholic University,

Faculty of Information Technology,

Budapest,

Stochastic processes

2004/2005/I

Probability theory and statistics (lecturer)

2004/2005/II

b. Postgraduate

courses

Gerencsér, L.:

Eötvös Loránd University

Faculty of Natural

Sciences,

Budapest

Statistical theory of non-linear stochastic systems, I. (seminar)

2003/2004/II.

Eötvös Loránd University

Faculty of Natural

Sciences,

Budapest

Statistical theory of non-linear stochastic systems, II. (seminar)

2004/2005/I.

c. Ph.D.

students

Molnár-Sáska, G.: Hidden Markov processes in financial modelling (1999-)

Budapest University of Technology and Economics

“Computer Science” Ph.D. program

Supervisors: M. Bolla

and L. Gerencsér

Mátyás, Z.: Behaviour

models of financial markets (2002-)

Eötvös Loránd University, Budapest, Faculty of Natural Sciences,

“Applied Mathematics” Ph.D. program

Supervisor: L. Gerencsér

Orlovits, Zs.: Statistical estimation of economic time series. (2003-)

Eötvös Loránd University, Budapest, Faculty of Natural Sciences,

“Applied Mathematics” Ph.D. program

Supervisor: L. Gerencsér

APPENDIX 2.

SCIENTIFIC AND

OTHER ACTIVITIES

International

activities

Editorial

IEEE Transactions

on Automatic Control, (L. Gerencsér, 2001-2004)

SIAM J. Control and Optimization (L. Gerencsér, 1998-2004)

Conference

organization:

International Program

Committee for the 2005 joint CDC-ECC (L. Gerencsér)

ERNSI (European Research Network on System Identification) Workshop on System Identification 2004, Dobogókő, October 4-6, 2004. Local chairman (L. Gerencsér).

Memberships (L. Gerencsér)

ERCIM Working Group on Control and Systems,

chairman (L. Gerencsér).

ERNSI (European Network for System Identification), 2003-

IEEE Control Systems Society Committee for International Affairs

Vice Chair of the IFAC Techical Committe on Stochastic Systems

Local activity

L. Gerencsér is an associate editor for the Journal on Applied Mathematics (Alkalmazott Matematikai Lapok).

L. Gerencsér

is a member of the Committee for Operations Research of the

G. Molnár-Sáska is the secretary of the Seminar for

Applied Mathematics, Budapest University of Technology and Economics, Faculty

of Science.

Education

Z. Mátyás has received the degree of "Teacher of mathematics" at the Eötvös Loránd University, Budapest, Faculty of Natural Sciences (2000-2004).

Z. Mátyás finished his fourth year of study at the University of Economic Sciences and Public Administration, (2000-).